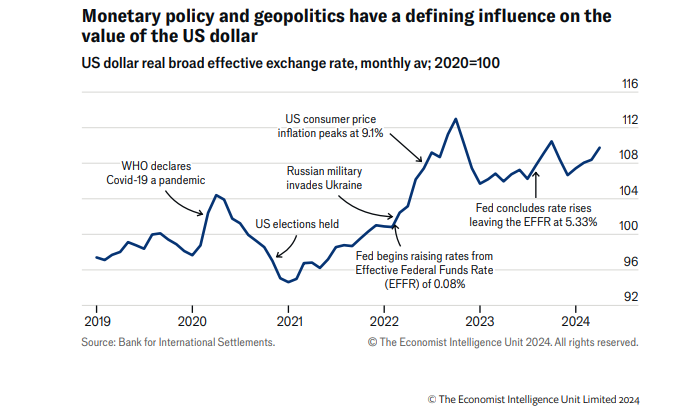

The US dollar remains close to an all-time high in real effective terms. According to the Economist Intelligence Unit, the remarkable resilience of the greenback is a reflection on the strength of the US economy, which has defied high interest rates and market predictions (a record-long period of yield curve inversion indicates so far unmet expectations of a major slowdown).

“High US policy rates and, more recently, investor repositioning in anticipation of a later start to US monetary easing have provided a large degree of support for the currency. However, the dollar has rarely been so strong relative to interest-rate differentials, suggesting that other factors are playing a significant role, not least elevated global political risk”, it revealed in an article “A stronger for longer US dollar: Predicting the effects on emerging markets”.

EIU, however, expects the dollar to weaken gradually from late 2024, but risks are tilted firmly towards

its strength persisting, adding, any US efforts to weaken its currency are likely to be in vain.

The London based firm continued that although May 2023 saw some easing in the broad value of the dollar, it is still above its long-term average and “We forecast that most other major currencies will register only minor cumulative gains before mid2025.”

“A later start to monetary easing than in other key markets, including the euro zone and the UK, will largely offset increasingly subdued US inflation and employment readings. Moreover, risks to this baseline forecast are tilted firmly towards a slower, rather than faster, retreat of US dollar strength”, it mentioned.

Meanwhile, the cedi has recorded some gains this week as corporate demand for dollar eases while the Bank of Ghana intervention improves.

So far, the cedi has gained about 0.41% to the US dollar. It is presently selling at GH¢14.90 to one American greenback at the forex bureaus