Ghana has missed out on the November 1 timeline set in the International Monetary Fund (IMF) programme to get a second tranche of the $3 billion bailout package as the country’s debt rework negotiations with external creditors delay.

The Black Star of Africa is still in talks with its external creditors for debt relief worth $10.5 billion. The country has already submitted proposals to its commercial creditors seeking a haircut of up to 40% and additional debt rework with its bilateral creditors including China and the Paris Club.

JoyNews checks from the Fund’s programme document reveal that Ghana has not been able to meet all the necessary financing assurances from its creditors to unlock the disbursement of the second tranche worth $600 million which was scheduled to hit Ghana’s account by November 1, 2023.

Prior to the first disbursement, Ghana had to secure financial assurance from its external creditors, a requirement fulfilled before the IMF Executive Board approved the payment.

There have been differing opinions on the conditions for receiving the second tranche of $600 million, which would bring the total disbursement to $1.2 billion after the Fund’s first review.

Ghana’s Information Minister, Kojo Oppong Nkrumah in October, stated in an interview with JoyNews that he does not believe an agreement with external creditors is a prerequisite for the disbursement of the second installment. “I don’t think that if we look at the fine print, that agreement is a condition precedent for accessing the next tranche”the minister expressed.

Earlier, the International Monetary Fund (IMF) Mission Chief for Ghana, Stephane Roudet had disclosed to JoyNews in an interview that government must secure the required financing assurance from external bilateral creditors before its board can approve the next tranche of funds for the country.

“Just like we got the financing assurance before Ghana secured the IMF programme, this financing agreement from the external creditors is needed before the IMF board approves the first programme review”the Mission Chief stressed.

Given the differing opinions, it is crucial to examine the IMF’s stance on the actions Ghana needs to take in order to secure the second tranche of disbursement.

What does the fine print say?

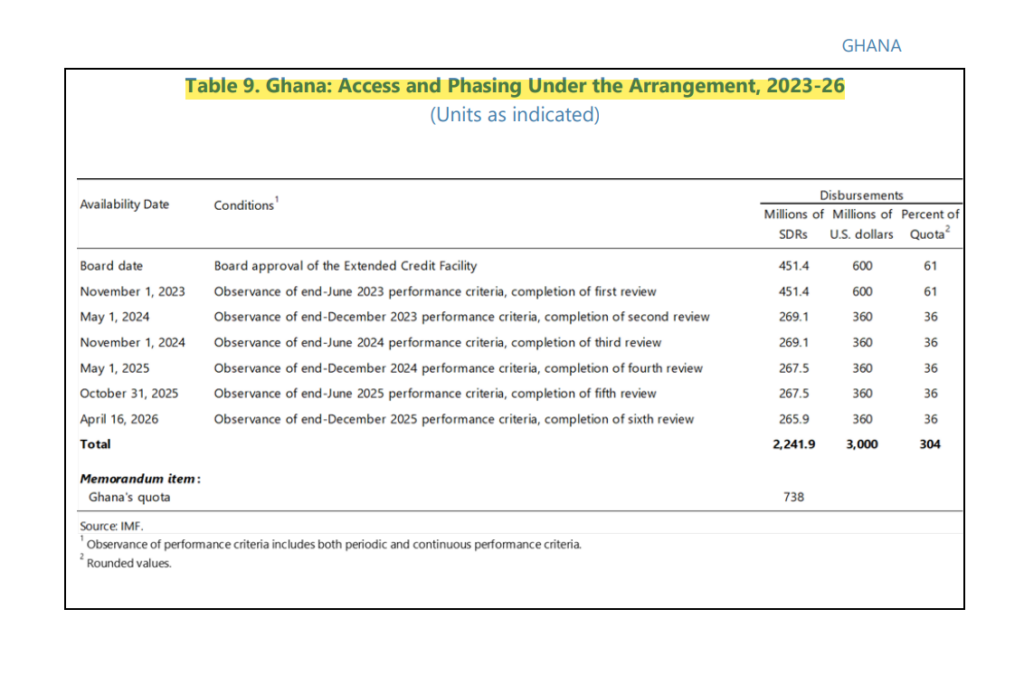

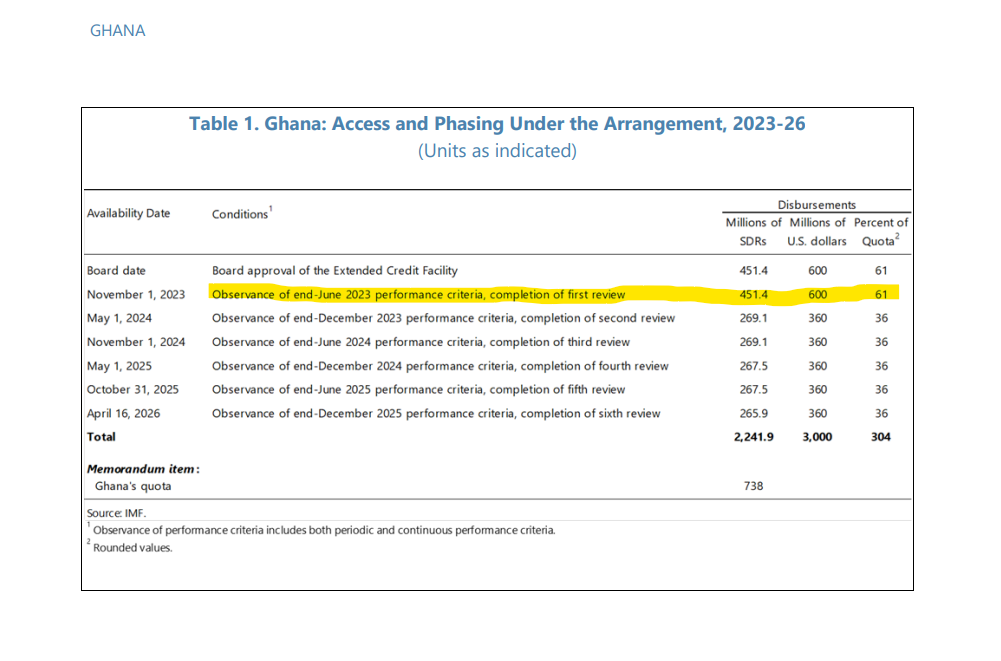

On page 72 of Ghana’s IMF programme titled “REQUEST FOR AN ARRANGEMENT UNDER THE EXTENDED CREDIT FACILITY”, it is indicated that completion of the first review of the programme will grant Ghana access to the second tranche of $600 million. This implies that without the successful completion of the first review, it is highly unlikely for Ghana to acquire the additional $600 million.

According to the Fund’s Press Release (PRESS RELEASE NO. 23/339) on October 6 2023, “Ghana will have access to about US$600 million in financing once the review is approved by IMF Management and formally completed by the IMF Executive Board.”

What will make IMF Executive Board approve the first review?

According to the same IMF press release, for Ghana to “ensure timely completion of the review, the country needs official creditors to quickly reach agreement on a debt treatment in line with the financing assurances they provided in May 2023.”

In less than 3 days after the contrasting opinions on what Ghana must do to gain the second tranche, the IMF’s Managing Director, Kristalina Georgieva congratulated Ghana on the recent staff-level agreement on the Fund-supported program’s first review. She however stressed that the Fund is “counting on bilateral creditors reaching an agreement on debt relief soon to move the review forward.”

The IMF’s directive is explicit: Ghana is required to secure financial assurance from its external creditors before gaining access to the subsequent $600 million tranche. Reaching this agreement with creditors is anticipated to elevate the total disbursement under the Fund’s program to $1.2 billion.

Additionally, Ghana’s debt arrangement with foreign creditors is projected to release approximately $2.5 billion in 2023 alone, aiding in bridging Ghana’s Balance of Payment deficit.

Source: Myjoyonline