Motor insurance premiums are expected to be increased by more than 30% from January 2024. The increase is due to a 21% increase in Value Added Tax (VAT) that will be imposed on non-life products from January 2024, in addition to at a 10% increase in Motor Insurance Premiums.

The Chief Executive of the Ghana Insurers Association, Dr. Kwesi Kwabahson, disclosed this to host George Wiafe on PM Express Business Edition on December 14, 2023. The development will also result in an increase in the cost of non-life products.

According to the Dr. Kwabahson, government is seeking to pass a law to legitimise the increase under a “Certificate of Urgency”.

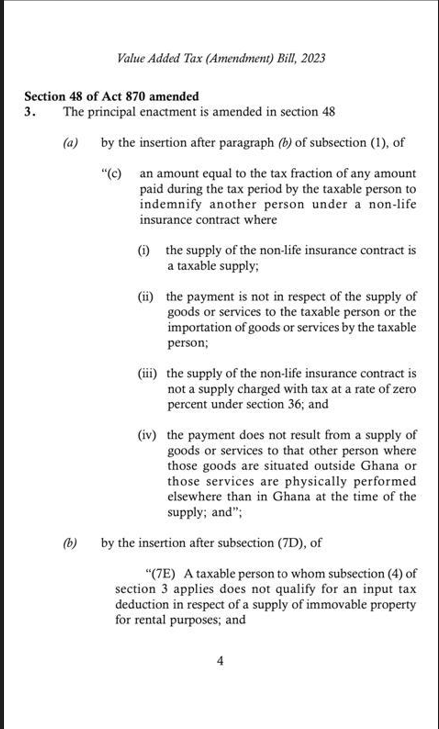

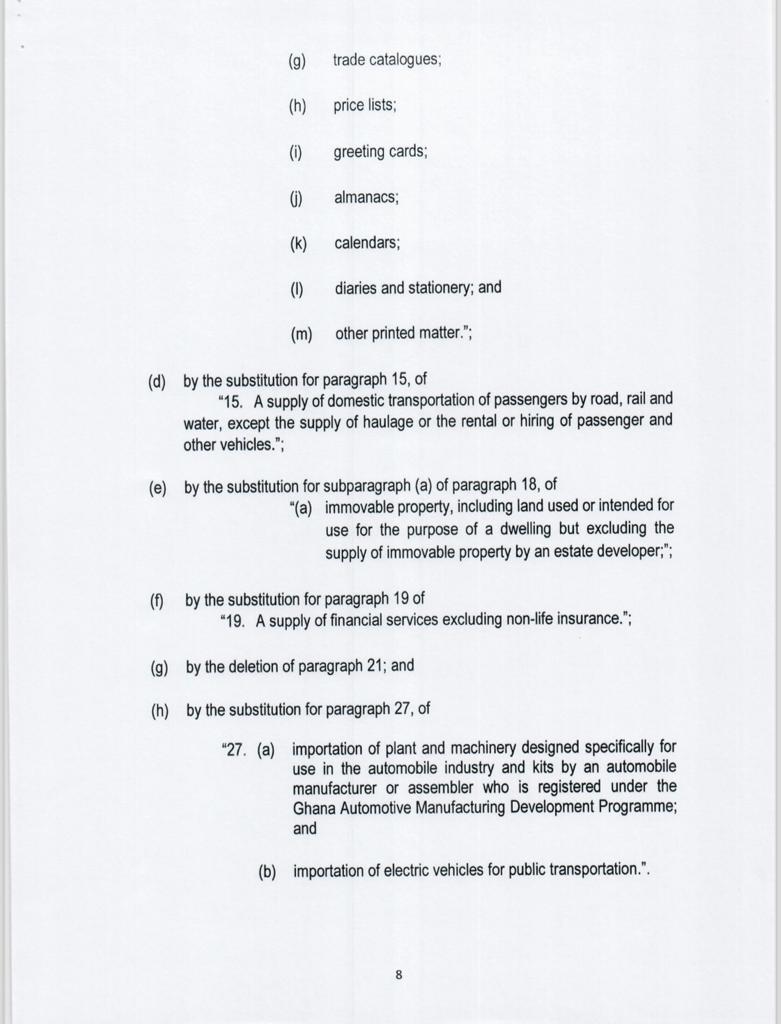

It will be implemented under the Value Added Tax Amendment Bill 2023, which is currently before parliament for consideration and approval.

Dr. Kwabahson noted that per the new calculations, a motor policy holder may end up paying 34% more than the current charges.

The Draft VAT Amendment Bill shows that provision of financial services are exempted, unless provision of Non-Life Business.

If the bill is approved by parliament, insurance firms will go ahead and charge 21% VAT on the supply of non-life products to the customers.

The bill also indicates that in relation to compensation to clients, there should be provision for some deductions to be done going forward.

Impact on insurance industry

Dr. Kwabahson noted that the insurance players are worried about the development because of how it could affect the growth of motor insurance in the country.

“Already, the industry is not doing that well, coming on the back of the Domestic Debt Exchange Programme shocks”, he said.

Dr. Kwabahson maintained that the move to impose VAT will rather hurt the industry than aid its growth, warning that “the biggest casualty here, will be the policy holders who may struggle to afford motor insurance going forward”.

“Already, we are struggling to convince every Ghanaian to take up insurance. What this move by government will do is that it may discourage a lot of people from signing up for the various non-life insurance products including motor insurance going forward”, he complained.

He pointed out that already, insurance companies are now recovering from the Domestic Debt Exchange Programme.

“Currently, we are compelled to cut the benefits, that one can enjoy from the Compensation Fund and that is as a result of the impact of the Debt Exchange Programme and the situation could be worse going forward if we increase the premiums”, he said.

The propose increase will affect Motor Insurance, Fire, Liability Insurance, Marine Insurance, as well as some of the compulsory insurance that are supposed to be taken and professional indemnity.

Dr. Kwabahson also disclosed that the association is currently engaging the regulator to see how their concerns can be addressed.

Proposed increase in capital requirement for insurance firms

The National Insurance Commission in January 2023 announced that it will place a moratorium on the Minimum Capital Requirements (MCRs) and Capital Adequacy Ratio (CAR) on insurers.

The current minimum capital requirement of life and non-life Insurance companies is ¢50 million, whilst the CAR is 14.2%.

Touching on the capital requirement, Dr. Kwabahson said the minimum capital requirement should be increased to strengthen the operations of insurance firms.

“We should make sure that we avoid idle capital, which might not be good for the industry”.

Price undercutting

There have been reports of some insurance companies embarking on what can be described as price undercutting, a development where some firms, price below approved industry and regulatory standards.

The development often make it difficult for insurance companies to meet their claims obligation when time is due.

Dr. Kwabahson assured that steps have been taken to deal with the issue.

He warned that the insurance act frowns on price undercutting and could attract serious sanctions if breached.

“We as an association as part of the self-regulatory measures are taking actions to ensure that everyone complies with this regulation”, he said.

Source: Myjoyonline